We should be worrying deflation more than inflation in spite of US printed trillions of dollars. People always say that inflation is a bad thing especially other countries like Venezuela that is having hyperinflation right now. But why is deflation worst than inflation? Why the opposite?

Difference between real economy and financial economy (consumer goods vs financial assets)

We need to differentiate the real economy and financial economy, because we could have an inflation in real economy for consumer goods, while a deflation in our financial economy, or vice versa. Why this printing money may not create (high) inflation? Because most of the money printed did not go to the consumer market, instead, it went into financial market. Consumer did not spend much of the money in consumer market, corporate cut budget in spending, hence the demand for real goods and services remained suppressed, but demand for financial assets increased. However, if the financial market collapsed, or when people starting to focus more on the real market, then inflation will slower come back as consumer starting to spend more on the economy instead of financial assets. What we are seeing now is everyone is so aggressive about investing in stocks and crypto-currency as FOMO effect – fear of missing out.

Discover more topics via spotify. Discover more topics via Spotify

What the media telling us to do and what’s happening

When social media and those Gurus, millionaire and billionaire are preaching about “inflation” & “now it’s the best time to buy assets”, then it probably not a good time to buy and we should expect the opposite.

So why is majority of people is receiving this “good news” of inflation? Media use inflation as a reason for people to get into investing, especially stocks and crypto-currency. We could see the news from everywhere, that the world is going to have high inflation due to US have trillions of dollars for quantitative easing, and the money will eventually flow into stock market or other assets, so this is the best time to buy, and they also show a very promising graph of confidence of a bull market trend. So why are they encouraging people to buy into stocks and other assets? I believe because the rich men are going to earn 1 more round before the real crisis hit. They release good news and confidence into the market, telling everyone that the Covid crisis is gone, and the bull market is coming. With the manipulation and brain-washing, majority of people is believing and going into the market to ride the wave of bull market at the lowest point they believe and not going to miss what they have missed in year 2008. However, I believe this is just an illusion and the market will collapse. When that happens, people who get hurt will be those who believe it’s a bull market.

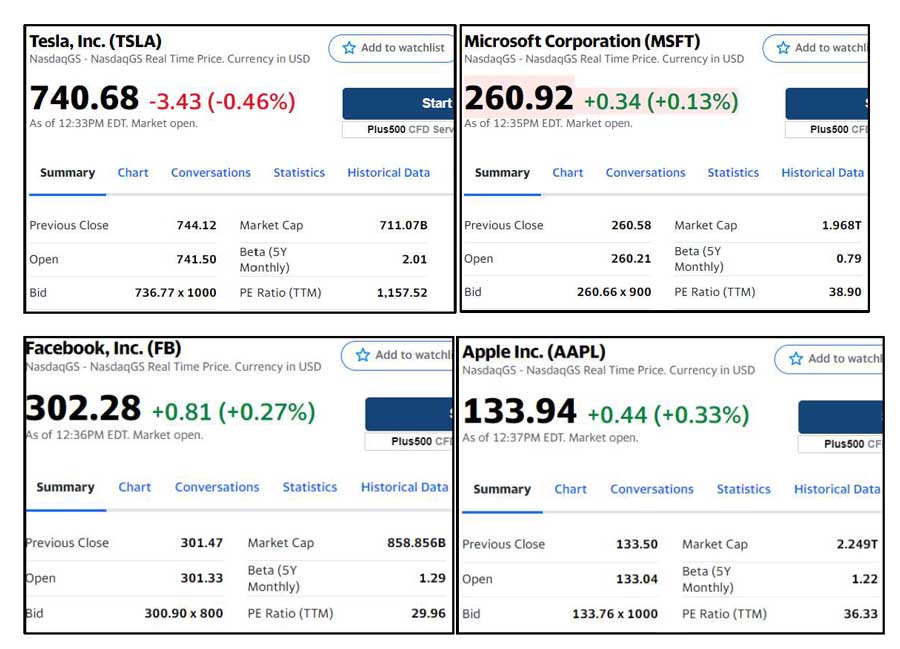

Source: Yahoo Finance, 21 April 2021

Source: Yahoo Finance, 21 April 2021

Now, Tesla has PE ratio 1,157 times, which is extremely overpriced as compared to Microsoft, FB and Apple, 38.90, 29.96 and 36.33. Most people are buying the “future” of Tesla with over thousand of PE ratio, in which I personally think that kind of confidence towards the company is way too much.

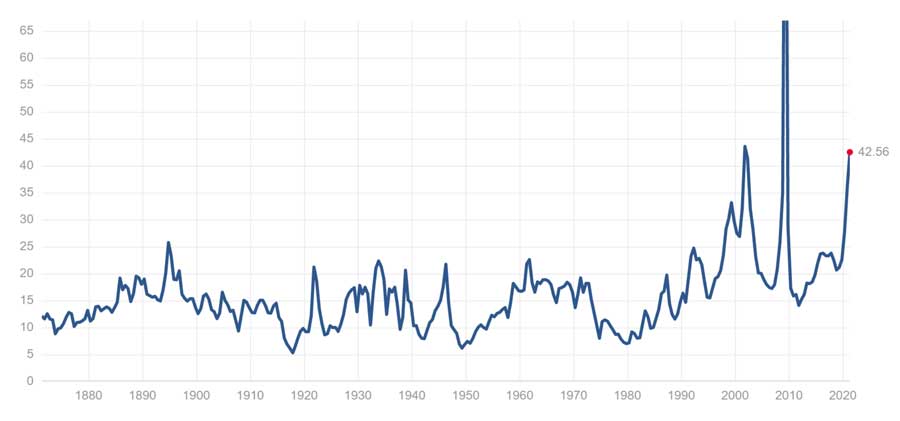

This is the S&P 500 PE ratio historical chart. Every time a sharp increase will lead to a sharp drop subsequently, and today we at the 2nd highest point in history, the highest is 2008 subprime crisis, the 2001 is 911 case. This is somehow not making sense, we just have our economy freeze in 2020 due to Covid-19, and the impact still continue till today, impacting the real economy, on the contrary, the financial market is showing promising, confidence and hopeful with sharp increment. Some people might believe that the worst is gone, hence we are expecting the recovery and therefore the sharp increase, but this just seem too good to be true.

Retail investors are the only party who buying stock now where institutional investors and foreign fund are selling. In history, the party who can win lot of money in stock market are those professional millionaire and billionaire, those normal retail investors are always the losing party. If retail investors had bought USD5.5billion in stock market and if it’s the start of a bull market, means retail investors is riding the right wave and will be earning money. However, history tells us that retail investors are always the losing side, hence if we think from reversed engineering perspective, it means it is not a real bull market- it could be an illusion.

Interest Rate

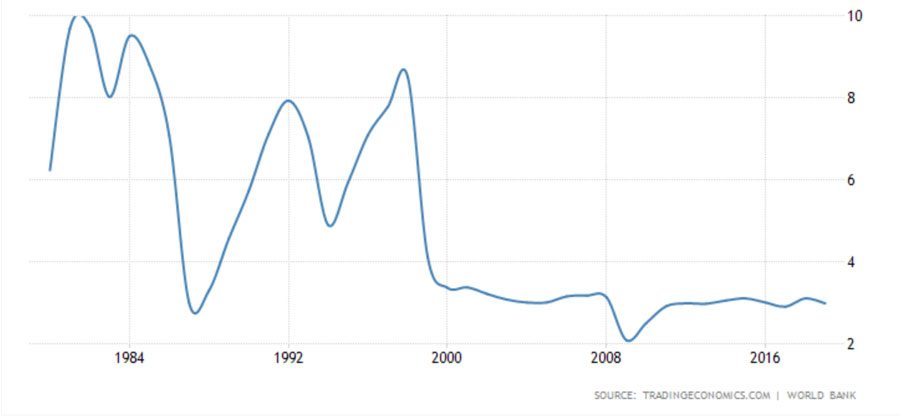

In mortgage, when interest rate is high, the instalment of property will be high, and lead to a high market rate rental. In general, when interest rate is high, this attracts people from saving and less investing into the market.

Malaysia is running low interest around year 2000, and keep it lower for the rest of 20 years. The low interest will allow buyer to afford instalment for higher property value. For example, if someone with disposable income of RM2,000 per month, when interest rate at 3%, the loan value is 520k. However, when interest rate is increased to 4%, the loan value is decreased to 420k.

| Interest Rate | Loan Amount |

|---|---|

| 3% | RM520k |

| 4% | RM420k |

Understanding Malaysia property cycle here.

For people who bought property before year 2000 at high interest, the property price is low due to their affordability. When low interest era arrived after year 2000, people started to be able to afford higher value property due to lower instalment, hence property price is artificially increased and those who bought before year 2000 enjoy the multiple-fold increment of property price.

What happen when property price increase after year 2008? The interest was at the lowest point and why property prices still increase for years. One of the reasons I could think of is because of subprime crisis. There was a major correction and together with increased money supply, lowest interest rate, and lower bank reserve ratio, people were encouraged to buy more assets in order to stimulate the market, and with the low interest continues for so many years, people were going into the market due to having good prospect in investing– a bull market. Therefore, the prices were in an inflated high level which led to this big bubble. With another low interest era coming in 2021, there could be very high possibility that the market no longer able to sustain such boom, and will either lead to a crash or a deflation up to 30% - 50%.

About rental, as said above, high interest rate leads to high instalment and then leads to high market rental. When interest rate getting low for coming years, the instalment dropped, as more affordable housing available, more people can afford buying instead of renting. Due to the competitiveness, house-owners have more buffer for lower rental due to lower instalment as compared to previous year. Hence if the market continues in low production, the rental will be pushed down due to competition and lower instalment, which will lead to a rental deflation as well. This scenario is more severe compare to old days because after year 2008, more middle-income people are coming into the property market as “investor” instead of home-buyer. Old days, property are for the rich with high holding power. After 2008, more and more people who do not have high income but still be able to get property due to low interest rate and bank lenience on loan. This leads to another bubble. Therefore, with current pressure of rental competition, this group of panic investors will lower their rentals to lowest possible in order to attract tenants as they have little to no holding power. Not to mention about the pressure of loan compression magnifies the impact.

Another side of property

At this moment, we cannot treat houses as necessity product any more (old days yes, house consider necessity for most people). Just like gold, people buy gold for hedging or investing, not only for fashion accessory (if gold is consumer product, it will be increasing price steadily due to inflation instead of having high volatility). Today, houses are more towards an investment product. Hence if we still taking supply-demand theory to analyse the price of house, this will lead to a wrong direction. Nowadays people buy houses because they believe a myth of “property will only go up and never go down” or “property price will double up in every 10 years”, which lead to houses now became an investment commodity. Many people buying property hoping that it will rise in future, and then sell it. However, the fact is, when majority of people who think that same way and plan exactly the same, this usually won’t happen.

And of course, simple mathematics equation can solve this myth of “property price will double up in every 10 years”. Imagine a house worth 100k in year 0, 40 years later (4 times of double up), become 1.6mil. According to inflation rate, the average inflation rate per annum is 7.177% for 40 years, which make no sense.

To certain extend, property price will go up in long run (just like gold) or unless we have alternative in accommodation needs. However, as people always have fund-limitation, opportunity cost and holding power issue, hence not everyone can hold the property long enough for profit and withstand its stagnation of price if not drop.

What to do?

Keep more cash, buy good asset when it is undervalued. For undervalued properties visit RPC Inner Circle.

「If this article is useful to you, feel free to buy me a coffee ☕」

If this article is useful to you, feel free to buy me a coffee ☕