A real estate investment trust is also known as an REIT. Although the definition of a trust refers to the position of trustee, an individual responsible for financial transactions on behalf of another, it is the combined term investment trust that truly defines an REIT. It is, in its truest form, a tax designation for a corporation investing in real estate that actually may serve to reduce or even altogether eliminate corporate income tax. The structure of a real estate investment trust corresponds to real estate investment much the same way as a mutual fund corresponds to investment in the stock market.

REITs pay little to no income tax to LHDN but this benefit is given in exchange for the trust to distribute at least 90% of the taxable income, annually, in the form of dividends to the shareholders. Dividends are payments made by a company to its shareholders after making a profit. This money is usually guaranteed to the shareholders except in cases of extreme profit loss. Even in situations like this, retained earnings can be used to distribute dividends to the shareholders in order to remain within the provisos of the agreement so as not pay corporate income tax.

If Real Estate Investment Trust is not something for you, then perhaps you should get our 9 Useful Guides For Newbie in Property Investment for free here. Otherwise, continue reading.

In many typical REITs, have actually distributed all of their current earnings or sometimes even more than their current earnings. This can often result in dividend yields comparable to bond yields. If in fact an REIT distributes more than its taxable income, the extra distribution is considered a return of capital for tax purposes. This means it is taxed as a capital transaction, rather than regular income. The distribution requirement may hinder a REIT’s ability to retain earnings and generate growth from internal resources.

Real Estate Investment Trust & Mutual Fund

Real investment can be an intimidating process but as with anything, there is assistance available. Mutual funds can be seen as a way for those less confident in their stock savvy to join together with like-minded individuals and to profit from a well-rounded portfolio. A real estate investment trust is very similar to the mutual fund. It is, in its own arena, a means of pooling together various finances as well as a recruitment tool for investors in order to capitalize off of the real estate market. REIT investment is a relatively safe avenue to take when attempting to break into the ever fluctuating real estate market. It is a place where novice investors can go and feel safe and secure in their investment endeavors. The full brunt of any loss that may happen is taken by the corporation and even in a losing situation; dividends are often still available for distribution. This is unheard of in the stock market.

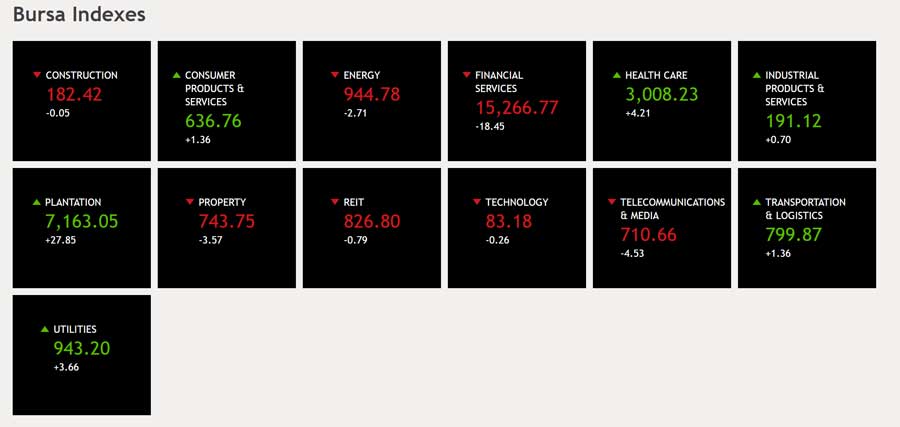

Real Estate Investment Trust in Bursa Malaysia

A market index is a hypothetical portfolio of investment holdings that represents a segment of the financial market. The calculation of the index value comes from the prices of the underlying holdings. Some indexes have values based on market-cap weighting, revenue-weighting, float-weighting, and fundamental-weighting. Weighting is a method of adjusting the individual impact of items in an index.

Before the introduction of Real Estate Investment Trust, an investor may invest in property stocks and/or physical (tangible) property to get exposure in the real estate sector.

Investors now have an option to invest in REITs by paying only a fraction of the real estate prices. In other words, REITs provide a way to invest in quality large-scale commercial real estate without having to buy the properties directly. REITs typically offer you a stable income stream and attractive distribution yields.

Real Estate Invesment Trust Dividends

The best part of REITs is that you get to enjoy the return without even need to know about property investing. As REITs are public traded, you would analyse the counters just like any other stocks for their income statement, cash flow statement and balance sheet.

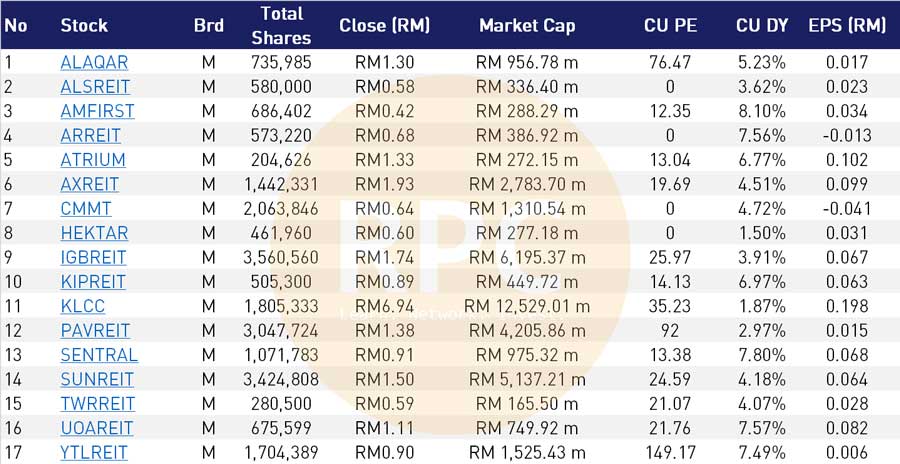

If we look at the table above, on average we are looking at 5.23% dividend yield. REITs are mostly stable as to compare with other sectors. Of course, if we dive deep into stocks analysis we have to see what kind of assets that the company is holding in their portfolio. From there, we could see if there is any potential for investing long term. Physical properties are typically giving lower rental yield with landed properties between 1.5% - 2.0% and high rise residential properties between 3.5% - 4.5%. With REITs, you are getting higher yield yet without the hassle of managing the property!

Real Estate Investment Trust Benefits

Affordability

Investments in REITs cost a fraction of the cost of direct investment in real estate. You can start off with minimal investment outlay. This could be less than RM100 - RM500 initial capital to start investing. Direct real estate you need at least 10% of the purchase price. Imaging if we are buying a flat in Kuala Lumpur for RM100,000 then we need RM10,000 as down payment.

Liquidity

REITs are more liquid compared to physical properties. Units of listed REITs are readily converted to cash as they are traded on the stock exchange. While physical properties need at least three months to nine months to complete the transfer of ownership.

Stable income stream

REITs tend to pay out steady incomes (similar to dividends), which are derived from existing rents paid by tenants who occupy the REITs’ properties. Best yet, you don’t have to manage the properties or dealing with tenants.

Exposure to large-scale real estate

You can derive the benefits of the real estate on a pro-rated basis through a REIT, a quality investment which is affordable.

Professional management

You benefit from having the REIT and its underlying assets managed by professionals who will add value for a higher yield.

Conclusion

Both REITs and physical properties are great to invest. In my opinion, so long you manage your investment portfolio well it shouldn’t be any issue regardless of which investment vehicle you put your money in. Word of advise: - You should never put all eggs into one basket. This is something that I learnt last year during Covid-19 pandemic outbreak in March 2020. Though my stocks portfolio dropped more than 45% at the time, yet I still receiving rental income from my properties. Let’s continue investing!

「If this article is useful to you, feel free to buy me a coffee ☕」

If this article is useful to you, feel free to buy me a coffee ☕