This question ‘Should I invest in Property Now’; has been asked countless times. Of course, we can’t blame people because the market sentiment is on the lowest since last year. In fact, I personally don’t think the market will recover by year end which I covered in previous blog.

You can read about the post - Malaysia Property Market 2021 Set For Year-End Bounce? A Bit Optimistic

When the market is not recovering anytime soon, it means we (investors) have more time to get more good deals in the market.

Many people think that it is not sensible to buy property in the current market because of the uncertainties. With pandemic, there has been a great fear among the people and they are not sure if their savings will get affected by it. This has created a downward trend in market sentiment and this might lead to an uncertain future for all of us.

At the same time, the banks are tightening the criteria on giving out loans. From what I see, the banks are focusing’ on financing buyers in primary market more than secondary market.

In fact, we should do the opposite. Of course we have to assess our risk at every angle. During this hard time, risk assessment should be doubled up compare with before. That doesn’t mean we have to stop investing entirely.

I personally don’t think there is any major differences in real estate in other countries than Malaysia. Malaysia is not that unique’ that has its own real estate market.

The only difference is the timing and trend. Other than that, majority real estates work the same. Follow the basic economic fundamental supply and demand.

The world is start moving now thanks to vaccination rate increase. Investors are investing in real estate right now. One of the reasons is to hedge against inflation.

When the economy reopen (inevitable) from lock down, fueled by low interest rates, ample of supply in the market with bargain and inflation is anticipated make real estate an attractive investment.

Investors are fully aware when inflation hits, the value for the cash sitting in the bank will decrease.

The issue is that people are uncertain about the future of the economy and markets. The pandemic has also led to an increase in insecurity for many people, who want to save money instead of spending it on buying property. This has resulted in the sentiment towards property becoming negative, which then translates into reluctance from buyers who don’t want to take that risk.

Property Investors Are Making Their Move

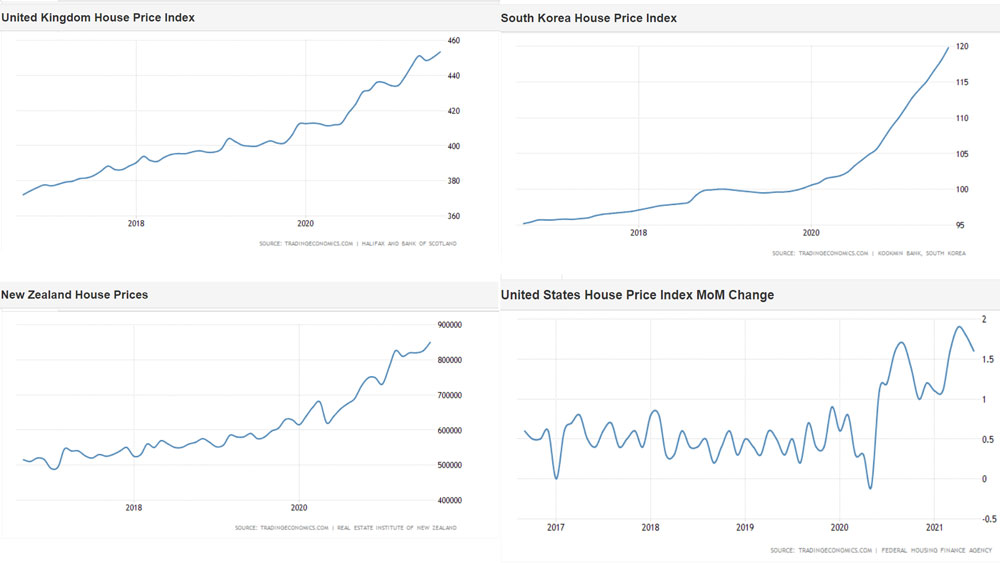

From the Housing Price Index from TradingEconomics.com for few major countries in the world, shows that investors are stocking up their inventory by investing in real estates. Just like I mentioned above, the reason is simple. Hedge against inflation.

The market is in favour for investors for low interest rates, desperate sellers caused by pandemic outbreak, undervalue properties etc.

What the graphs are telling is:

- The economy will open when vaccination rate increase;

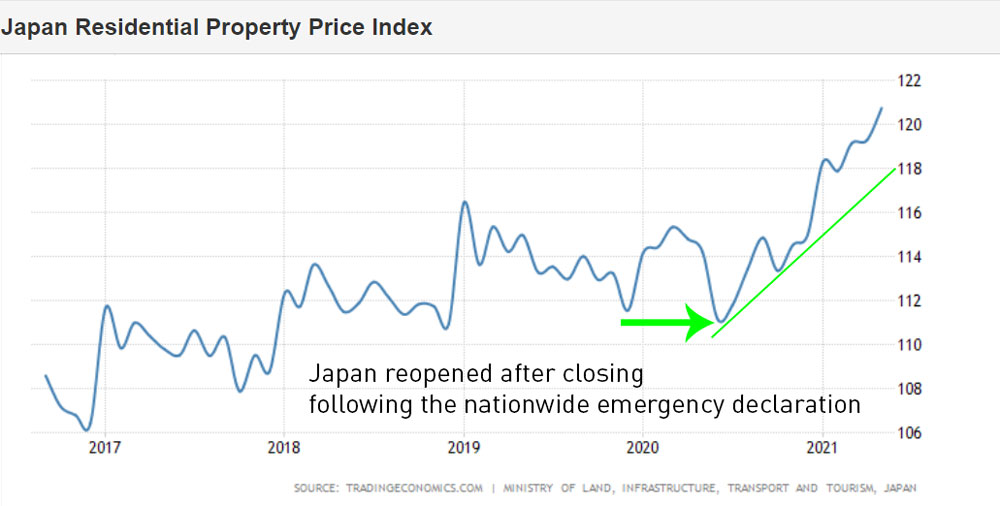

- Countries that removed the lock down order see spike in real estate activities;

- Real estate hedge against anticipated inflation;

- Real estate bubble is imminent;

- Investors dominated the real estate market.

The economy will open when vaccination rate increase

We already witnessed that the economy is slowly opening in many states in Malaysia. We have achieved 78.2% for full vaccination for adults. Based on the vaccination rate, we could reach 100% vaccination for adults by January 2022.

The end to lock down is crucial for economy to thrive. We need to have clear policy for manufacturing sector to run at 100% capacity while other sectors to follow.

Foreign investment will only come in when the government draw out a clear policy.

Countries that removed the lock down order see spike in real estate activities

Is it coincidence? It appears that when the lock down order lifted, we could see real estate activities increased significantly. We could see this happened in many major countries where prices increased since last year. Though the exact timing for the boom differs but the patterns are similar.

If all countries are having the same pattern for real estate boom, what makes us Malaysia to act differently?

Real estate hedge against anticipated inflation

What makes an investor apart from home buyers is the ability to foresee what is anticipated’ to happen in the market.

Investors will usually make the first move before anyone else. Simply because the decision making is different. Investors do not make decision base on emotions, as in do they like the area, would there be traffic jam etc.

Instead, investors will look at facts and figures. Things that investors are looking:- rental yield, price per square foot, occupancy rate, below market value, valuation, loan-to-value etc.

Inflation will hit faster than we could imagine. Those that set off their plan to buy property early would see high return. While many people savings their money, they would lose out when inflation hits. The buying power become less.

I strongly recommend to watch this YouTube video How the Economic Machine Works by Ray Dalio

Coming back to Malaysia real estate landscape, we could see the price is certainly on the low side. But investors are having a challenge with the banks. It is a norm that we buy property using financing from the banks. We tend to leverage to yield greater returns.

Unfortunately, banks are focusing more on primary market (new development) properties than secondary market (subsale).

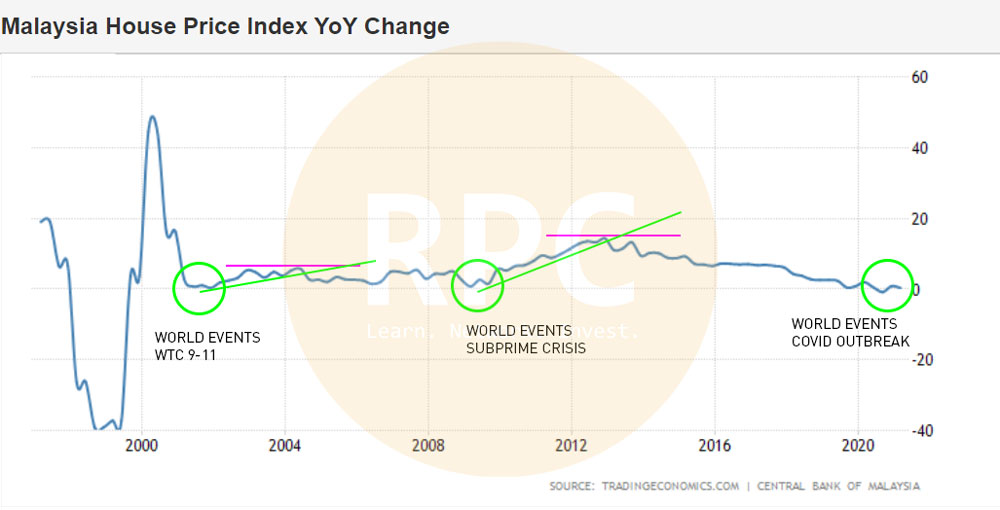

I don’t foresee the index will have significant drop mimic the 1997 Asian Financial Crisis. The Asian Financial Crisis was so severe because it is predominantly started in Southeast Asia.

The way how I look at current situation is certainly dampen any economic growth but not to the extent in 1997. We have seen few world events that shook the world yet the index still hovering above positive.

Real estate bubble is imminent

When the economy recovers with mega projects on the way, jobs are being created. Money start flowing in the market.

This in turns makes people more credit worthy to get financing from the bank.

When everyone can get credit facilities from the banks, will eventually create a real estate bubble. From the House Price Index charts for major countries above, show that they are experiencing real estate bubble.

Malaysia is no exception.

After the 2008 subprime crisis in the U.S., Malaysia property boom starting around 2009. We could see tower cranes over the skylines. Malaysia property boom peak in 2013. There after the price starts to go down a little then side way for good number of years.

Those that bought property in 2013, especially for investment purposes will feel the pain for the most losses.

Being investor is to have the ability to act before the market becomes a bubble. Learning from past experience, 2013 is the time to offload any under performing properties.

Do remember that you should always keep good properties with you for the sake of growing your personal net worth.

Investors dominated the real estate market

Property investors know when to go in the market. Not only they have the technical knowledge but they have the financial capacity as well. Not to mention that they have the network that make their investment much easier.

Home buyers will usually lose out when it comes to competing with investors for similar properties. The reason is because home buyers would not know the actual value of the property. In fact, value is usually come secondary priority. The emotions and the reasons to buy any particular property will supersede the value. Home buyers wouldn’t mind to pay higher price for they buying the property for own stay. Those that couldn’t compete on the price will eventually lose out.

Property prices will continue to rise over long term.

Conclusion

Those with good financial profile should consider to invest now. As the evidence shows that real estate bubble is imminent. The peak of the bubble is where we dispose our properties. That if flipping is your strategy.

And of course, the key fundamental in successful investment is managing risk. As I mentioned before, consider to invest in subsale properties value below RM500k. This is because it is much easier to rent properties within this range. Always look for rental yield in deciding which properties to buy.

Numbers never lie!

Trust the numbers and don’t emotionally attached to the property. Your property is a product. And the same property act as a tool to grow your wealth. Your ultimate goal should be making X profit or value when you retire.

I will be having a FREE training to help you to get started on your first investment property. You can register for FREE here.

「If this article is useful to you, feel free to buy me a coffee ☕」

If this article is useful to you, feel free to buy me a coffee ☕