TL;DR

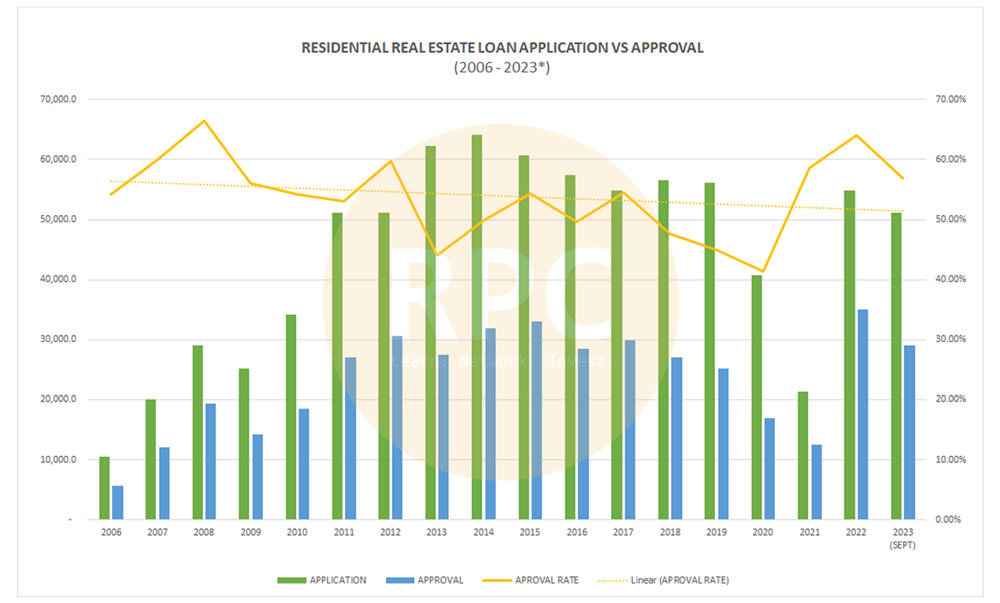

- As of Sept 2023, the total approved loan value exceeds RM29B;

- The loan approval rate for 2023 (Q3) is 56% exceeding property peak in 2013;

- People are still buying properties with supply for unsold properties reducing;

- High rise properties with the price below RM600,000 is the most transacted.

Since the pandemic outbreak, we still feel that the general market is not fully recovered yet. Many sectors are still feeling the pinch and consumers are feeling the pressure of rising cost of living. In this article, we are going to find the plausible answers to the questions in property market.

- Property market is not moving is it because banks not granting loan?;

- Are the people still buying property?;

- Which segment and price range that are actually moving?

However, before we answer the questions above, it is worthwhile for us to understand that causes the banks to become so stringent in giving out loans. For this, we have to revisit the 2008 Financial Crisis that started from cheap loans and property bubble in the US.

A Decade’s Echo: Dissecting the 2008 Financial Crisis

During a recent chat with a banker, a recurrent topic kept making its way into our conversation: The Financial Crisis of 2008. For many, it was a life-altering event; for others, a distant, albeit significant, news headline. Malaysia was not badly affected from this. But what really transpired? With all the theories, opinions, and analyses, let’s travel back in time to truly understand the makings of this monumental financial cataclysm.

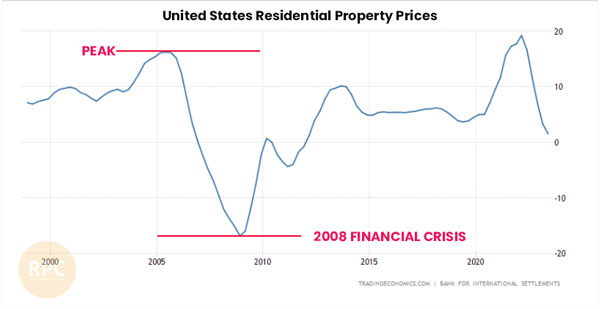

Setting the Stage: The Rise of Housing

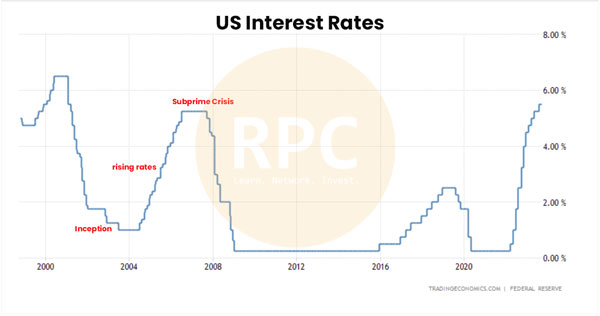

The roots of the 2008 crisis trace back to the booming U.S. housing market. A combination of low interest rates and ample liquidity led to an unprecedented surge in home prices. If you asked me, I’d say it was the perfect stage for the impending storm.

The shortage can be traced back to that 2008 housing crash and its long-term fallout. The buying frenzy seen throughout the 2000s had fueled a boom in new construction as builders rushed to meet unprecedented demand. But once the bubble burst, contractors pulled back on building in an effort to prop up demand. Construction rebounded slowly through the last decade, leaving the market with diminished inventories once the pandemic-era boom began.

Business Insider, April 2021

1. Subprime Mortgages: The Silent Instigator

The housing boom saw the rise of a specific kind of mortgage lending: the subprime mortgage. These were essentially loans offered to individuals with questionable creditworthiness. Many began to view housing as a fail-proof investment, believing prices would perpetually rise. Lenders, eager for profits, dispensed these risky loans, often with variable interest rates.

A subprime mortgage is a type of loan granted to individuals with poor credit scores—620 or less, and often below 600—who, as a result of their deficient credit histories, would not be able to qualify for conventional mortgages.

Investopedia

2. Financial Cocktail: The Creation of CDOs

Here’s where things get a bit intricate. Financial institutions bundled these subprime mortgages into complex financial instruments called Collateralized Debt Obligations (CDOs). These CDOs were then sold to investors globally. With high yields, they seemed irresistibly attractive. But beneath the surface, their true risk was obfuscated by financial engineering and poor credit ratings.

What is CODs

A Collateralized Debt Obligation (CDO) is a synthetic investment product that represents different loans bundled together and sold by the lender in the market. The holder of the collateralized debt obligation can, in theory, collect the borrowed amount from the original borrower at the end of the loan period. A collateralized debt obligation is a type of derivative security because its price (at least notionally) depends on the price of some other asset. CFI, December 2022

3. The Domino Effect

As variable interest rates on these subprime mortgages began to reset at higher rates, homeowners found themselves unable to meet their mortgage commitments. Defaults surged, and the housing market began its downward spiral. The CDOs, intrinsically linked to these mortgages, began to lose value. Financial institutions worldwide, who had heavily invested in these instruments, faced enormous losses.

4. Bank Failures and the Credit Crunch

Major financial institutions, underpinned by these toxic assets, found themselves on shaky ground. One of the first dominos to fall was Lehman Brothers, a stalwart of the banking industry. Its bankruptcy in September 2008 sent shockwaves throughout the global economy. Trust between banks eroded, leading to a severe credit crunch. Without liquidity, the machinery of global finance ground to a screeching halt.

5. A Global Recession

As banks faltered, stock markets plummeted, and panic spread. The crisis was no longer confined to the shores of the U.S. – it was global. Countries worldwide felt the repercussions, with economies slipping into recessions and countless individuals facing the dire realities of unemployment and financial instability.

Find out more about Subprime Mortgage Crisis

Money for Nothing and Checks for Free: Recent Developments in U.S. Subprime Mortgage Markets

Where Are We Heading Now?

Property market is not moving is it because banks not granting loan?

The aftermath of the 2008 financial crisis was characterised by stringent regulations, bank bailouts, and a renewed emphasis on ethical banking. Regulatory bodies worldwide took decisive action to prevent a recurrence, resulting in reforms targeting transparency, bank capital requirements, and risk management.

To answer our first question, is the banks to blame because they are not giving out loans?

From the graph above, we could see the peak of loan application is in year 2014. But that is not the main point that we could be looking at. In fact, we should look at the approval rate over the years. Since 2006, the banks had approved more than 50% applications on average. The only time when the banks approved less than 50% was in year 2013 as it was the hottest time in property market. Everything sold and at times, the asking price is much higher than the bank’s value! And yet, people still buying the properties.

Related: Read more about Property Cycle – Where Are We In The Real Estate Cycle 2020

To our surprise, the banks are actually giving out loans. In fact, current approval rate for year 2023 is updated September 2023. By December, the approval rate for year 2023 could easily become the top 5 since 2006.

And NO. The bank is still giving out loans and the value approved is much higher than previous years. As of Q3 2023, the value already reaching to RM29B as compared to RM27B back in 2013.

Are the people still buying property?

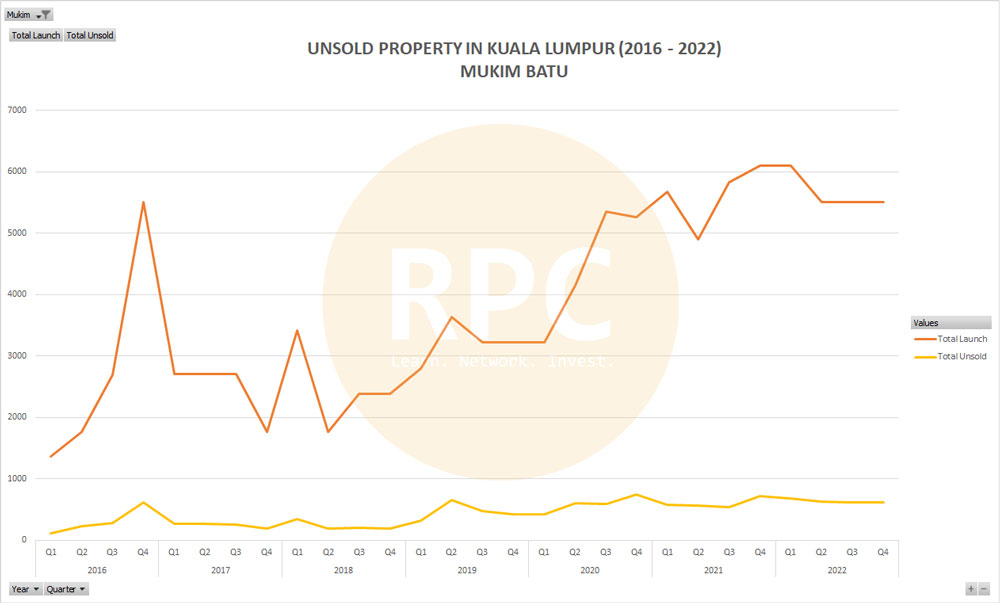

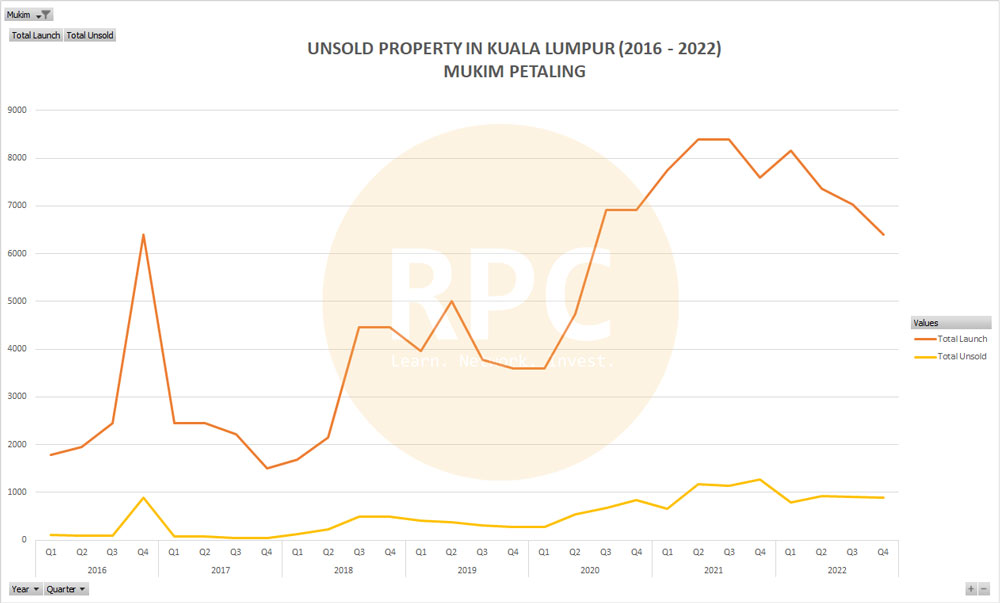

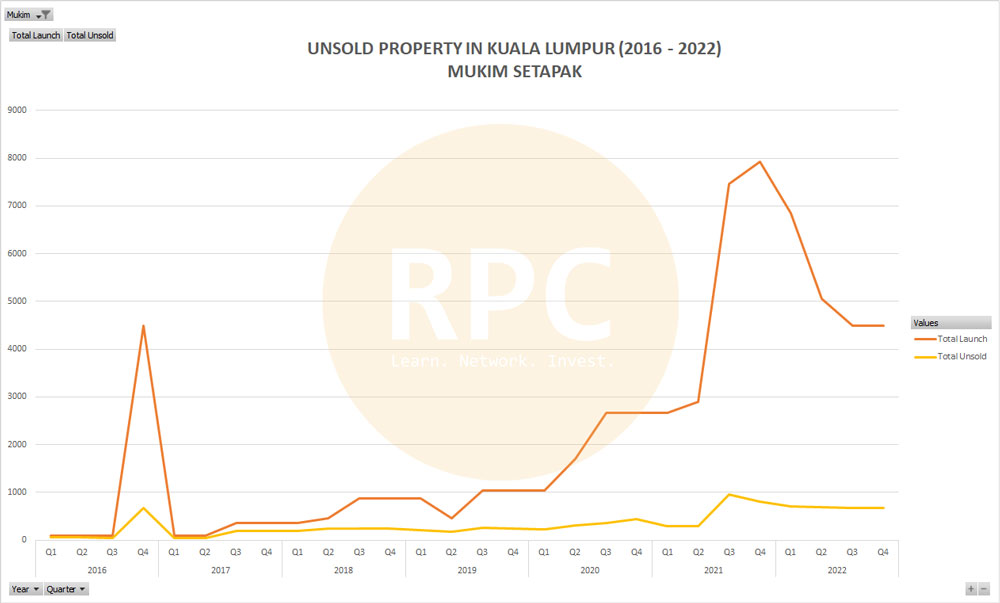

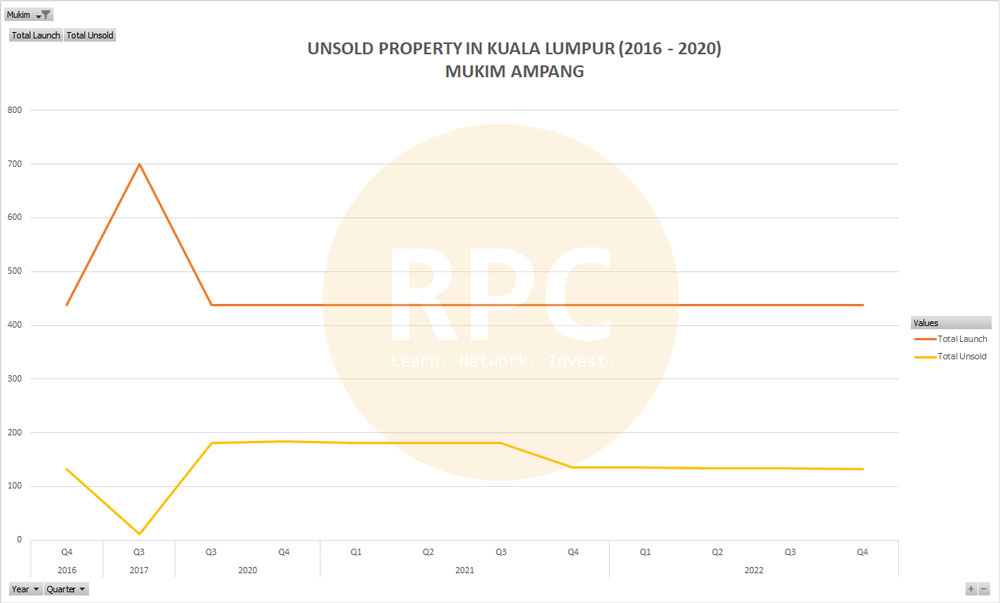

We can’t possibly covering the whole Malaysia property market in our analysis. Therefore, we selected the capital city as a reference to represent the general property market. After all, the most active area for buy and sell is none other than the capital city of Kuala Lumpur. For the setting, we are looking at high rise property mainly residential condominiums and serviced apartments only. This does not include secondary market. Reason being, we have limited access to data available for public access and at times, secondary market property tends to have higher capital upfront. This makes primary market property more favourable. The following information obtained from Napic.

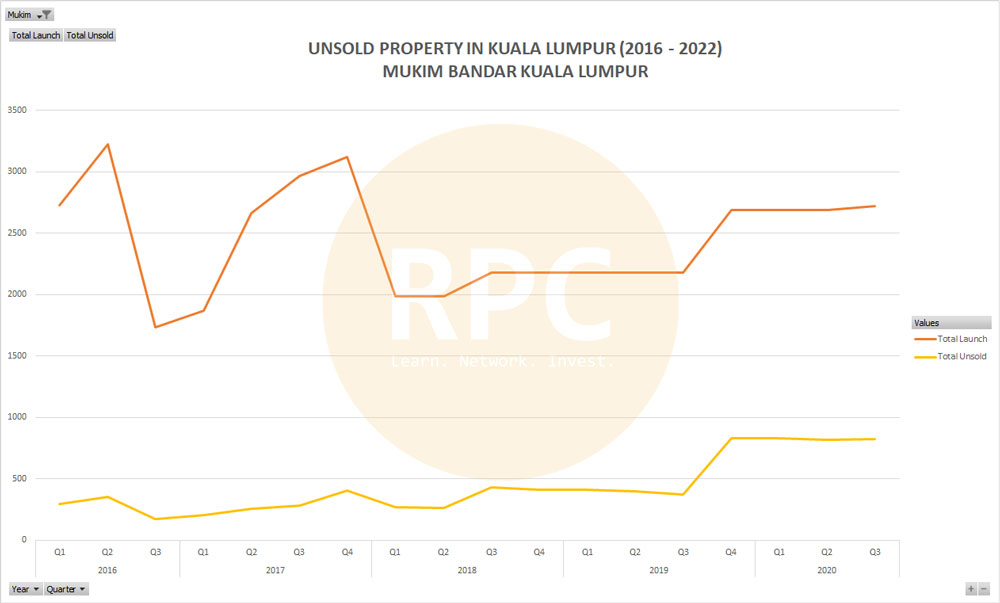

The graph above shows the unsold property in Kuala Lumpur City Centre. Since 2018, there isn’t many projects launched. The last new project launch was in Q4 2019. Since then, there isn’t any activities in KLCC area. The unsold properties remained the same since Q4 2019. What this is telling us? The average property price in KLCC area is about RM2,066,211 in absolute value, where RM1,245,397 being the lowest while RM3,239,221 being the highest.

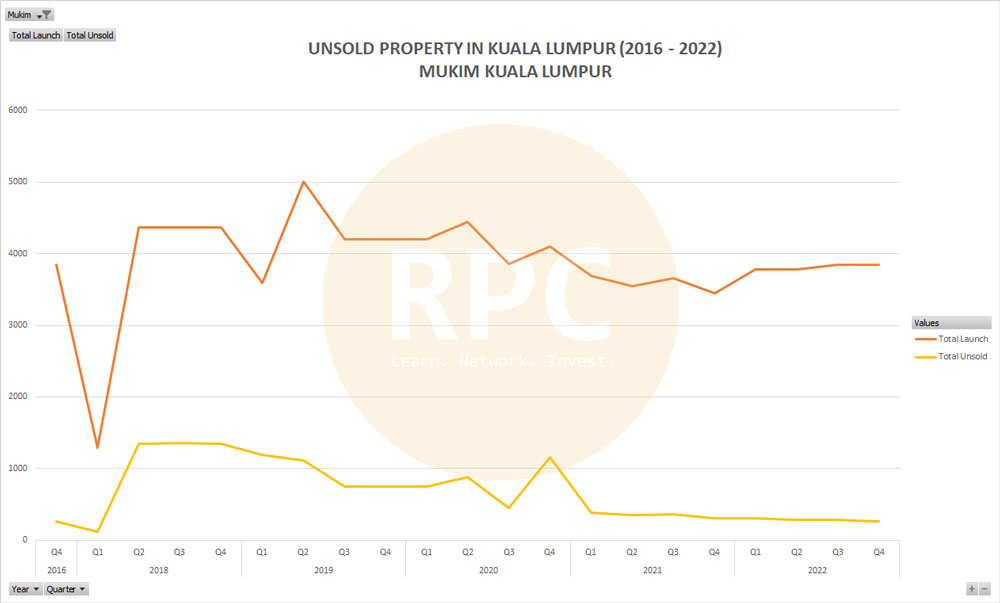

Do not get confused with Mukim Bandar Kuala Lumpur and Mukim Kuala Lumpur. As both are not the same district. Mukim Bandar Kuala Lumpur is KLCC and the area are Jalan Sultan Ismail, Bukit Ceylon, Bukit Bintang etc. While Mukim Kuala Lumpur is Jalan Klang Lama, Seputeh, Cheras, Pudu etc.

From the graph above, it seems like the take up rate is much higher. The only time where there was massive surge in supply is in 2018. After that, the supply seems in controlled. In fact, among all other districts in capital city, Mukim Kuala Lumpur is the only one with the least unsold residential properties.

From the information gathered from Napic, it seems the people are indeed continue buying property. This is also align with the increasing number of loan applications.

Click to see the graph of other districts.

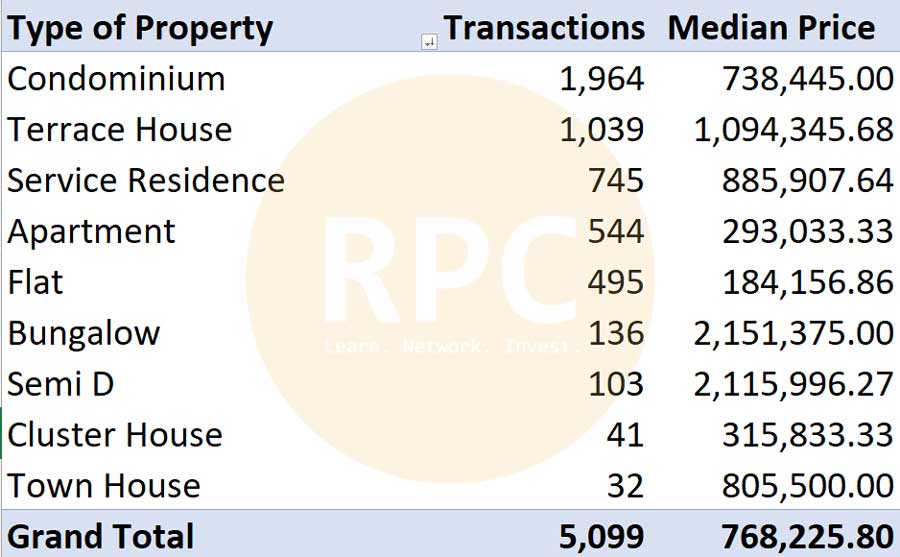

Which segment and price range that are actually moving?

The table below shows the type of properties with the most transactions in Kuala Lumpur (August 2022 – July 2023). It is not a surprise that high rise properties transacted the most. However, terrace house is the second preferred property to buy with significant transactions.

Although the median price for property is RM768,225, but if we were to look into the details, the property transacted are mostly range from RM300,000 – RM560,000.

The answer to the question which segment and price that are moving in current property market (as of Sept 2023), is high rise property with the inclusion of condominiums, apartments, serviced apartments and flats. The price range would be anywhere below RM600,000 on average.

Conclusion

From the above, we could see that it was not the loan that preventing people from buying or investing in property. In fact, if we were to compare with the total loan approved in Q3 2023 with years prior, the loan approved in 2023 is actually on par during property boom 2012 – 2015.

Of course, those properties unsold are those high end properties that value above RM1.2M. The properties below RM500,000 are actually transacting very well despite current economic uncertainties.

But one thing is certain, investors are investing in medium and lower segment in the market to manage their risk better. Also, it is much easier for investors to off-load the properties later.

feature photo: Munzir – Photography